A charity estimate template assists a user to write all components in this form which are related to charity transactions. It is a very handy tool with respect to recording charitable transactions which can be utilized while filling in tax returns. A charity is an act of kindness which reflects your love and affection towards needy people, mostly with the purpose of getting inner satisfaction. However, a charity estimate is made while making an arrangement of funds either from an individual or a company. These funds can help those people who are sick, poor or needy. If you are willing to do a charity for non-commercial human development activities or for medical facilities, only to show your inner kindness. You can estimate the value of funds which you desire to give to others as charity using your own skills, as well as with the assistance of a specialized analyst or estimator. In terms of business, all taxpayers are allowed a relaxation in the taxable amount, exempted by almost all governments, to encourage people to play their role towards the betterment of society. Whereas, this amount is further entitled to rebate in the annual tax calculation.

Tax Rebate and Charity Estimate Templates

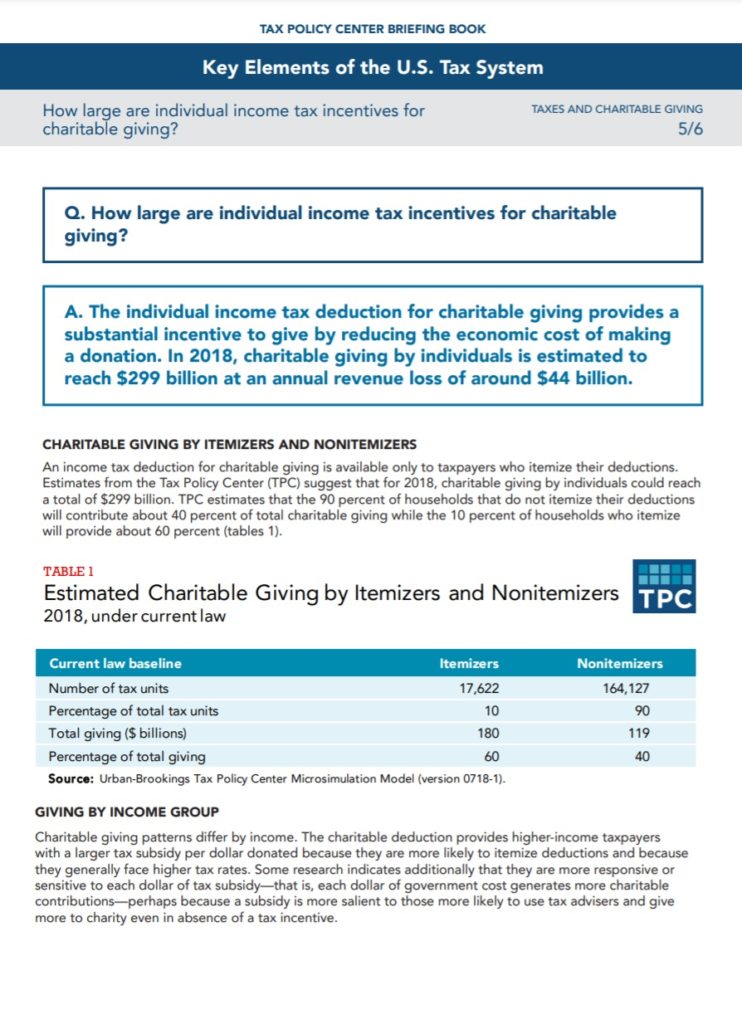

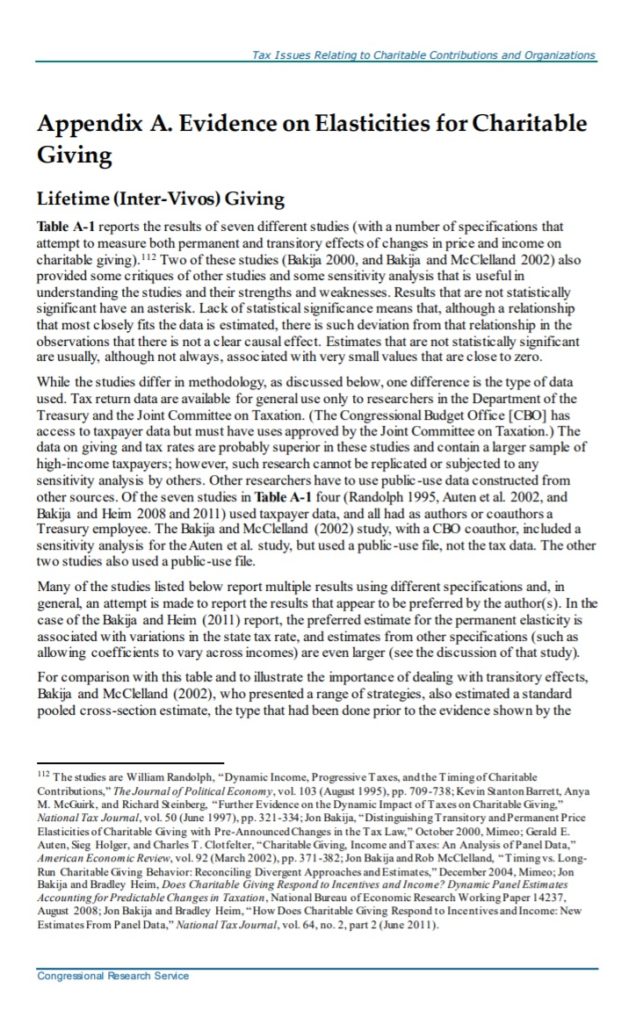

Perhaps, there are many agencies and firms all over the world, who are providing their professional services for calculating or annual charitable amounts. These estimate formats are very vital for these agencies while getting a possible tax rebate for you, either as an individual or as a corporate entity. As far as the taxable income rule or law is concerned, it allows a certain portion of your annual income as deductible from tax on account of charity. However, to avail certain tax privileges, an organization or an individual must be qualified for making charitable transfers. Whereas, a charity estimate template enables an individual or an organization to calculate exactly how much amount they can donate for charity purposes. Based on these calculations, an organization can further make arrangements for funds which they will not be able to use in business related activities.

Fundamentals of a Charity Estimate Form

Furthermore, there are three main fundamentals/factors that an estimator should have to consider before starting up the process of estimation. For instance:

• Details for Charity receiver organization.

• Type of contributed charity.

• Limit for amount that contributed as a charity.

Details of Charity Estimate

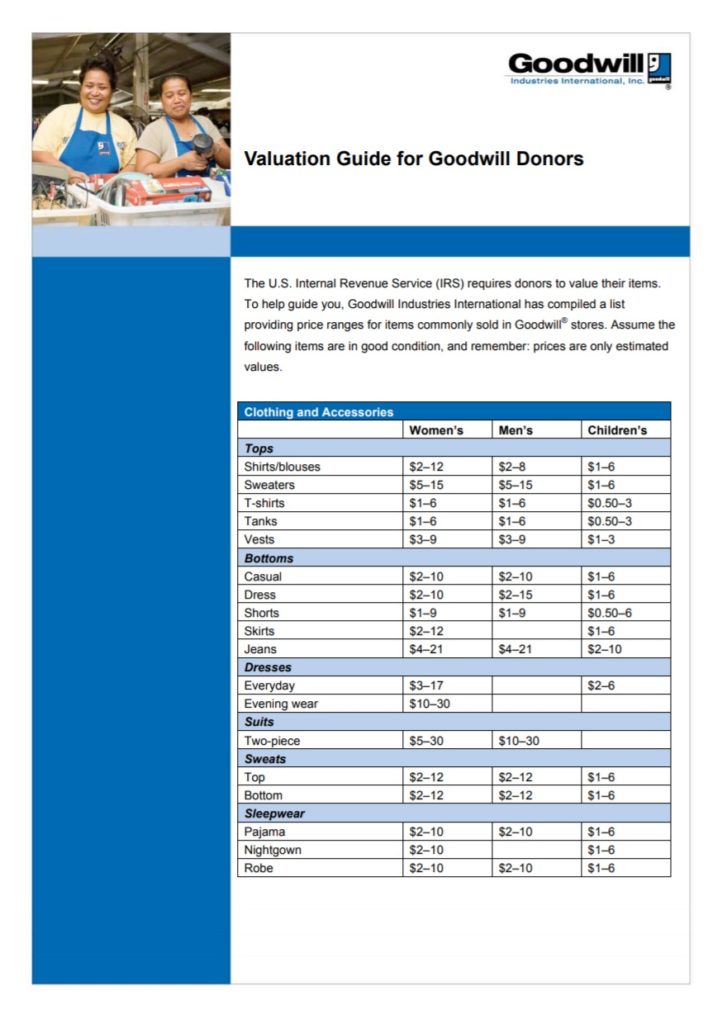

There are a number of occasions and reasons where an organization or an individual can donate their funds. These reasons or occasions are; natural circumstances, deadly changes in the climate, students paying expenses, study scholarships, contribution of property or land for needy people and organizations, vehicles for hospitals or rescue teams, funds to support children and poor families via food and clothes, and lastly, donations for sudden tragedies. The most common example of charity estimating is to estimate the cost of items, like clothing, food or other household things like electronic goods, appliances, furniture items and even more. A good or bad estimation of charity can throw your predictions and approximate guess of planning to a positive or negative phase.

Templates for Charity Estimate

www.taxpolicycenter.org

www.taxpolicycenter.org

www.goodwillswpa.org

www.goodwillswpa.org

sgp.fas.org

sgp.fas.org

www.urban.org

www.urban.org